In 2025, the real estate landscape demands both vision and pragmatism. From stagnant price growth to emerging niche sectors, understanding current dynamics is key to unlocking opportunity and building lasting wealth.

2025 Real Estate Market Overview

The U.S. housing market in 2025 remains largely stagnant, with growth projected at just 3% or less. Supply is inching upward but still sits 20-30% below prior troughs for existing homes. Meanwhile, new construction has surged to 481,000 units— the highest since 2007—driven by speculative developers adding 385,000 properties to the market.

Despite this uptick in inventory, demand is exceptionally low due largely to sustained high mortgage rates, currently hovering near 6.7% and expected to ease only slightly by year-end. First-time buyers struggle with affordability as income growth fails to match rising home values, which now average $360,727 nationally.

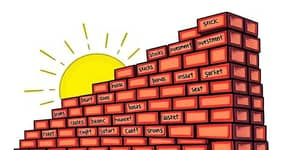

Key Investment Strategies for 2025

In this environment, investors must adapt to volatility and shifting trends. Relying on past playbooks can lead to missed opportunities or costly missteps. Instead, focus on four core pillars:

- Sustainability and Green Features: Properties equipped with solar arrays, smart thermostats, and green certifications command higher rents and resale premiums.

- Diversification Across Sectors: Balance residential holdings with commercial, mixed-use projects, and emerging asset classes like data centers or senior living.

- Technology Integration: Leverage predictive analytics and digital tools to source deals, underwrite risks, and optimize operational efficiency.

- Investment Models: Choose between passive vehicles—REITs, crowdfunding platforms—and active approaches such as strategic flips or long-term rentals.

Emerging Market Segments and Opportunities

- Residential Rentals: Multi-family units remain attractive given high rental demand and steady income streams, especially in urban and secondary markets.

- Commercial Mixed-Use: Combining residential, retail, and office spaces can mitigate risk through diverse revenue sources.

- Healthcare Real Estate: Senior living facilities benefit from demographic trends, offering lower vacancy rates and stable returns.

- Niche Sectors: Data centers, logistics warehouses, renewable energy–integrated properties, and short-term vacation rentals present specialized growth avenues.

- Luxury Segment: ‘‘Coastal modern’’ designs are surging in popularity, with median prices around $1.3 million and unique architectural features driving premium valuations.

Factors Influencing Decision-Making

Macroeconomic headwinds—persistent inflation and evolving fiscal policy—directly influence borrowing costs and buyer confidence. Any political shift toward mortgage market privatization could reshape lending practices and investor returns.

Environmental, Social, and Governance standards are no longer optional. Tenants and buyers increasingly seek properties with energy efficiency and green certifications, rewarding owners with lower operating costs and faster appreciation.

Financing options vary from traditional mortgages to seller carry and institutional capital partnerships. Given elevated interest rates, investors should maintain ample liquidity to react when market corrections present discounted assets.

Practical Tips for Investors and Homebuyers

- Set Clear Goals: Define whether you aim for short-term (flipping, cash flow generation) or long-term appreciation and legacy building.

- Diversify Holdings: Mix asset types, geographic markets, and risk profiles to smooth returns.

- Leverage Technology: Use market intelligence platforms and predictive models to guide acquisitions and pricing strategies.

- Prioritize ESG Features: Energy-efficient homes often see lower vacancy and stronger tenant loyalty.

- Monitor Local Dynamics: Track population shifts, job growth, and local regulatory changes to pinpoint high-potential micro-markets.

- Stay Educated: Engage with expert podcasts, webinars, and industry reports for continuous learning.

Property investing in 2025 is less about following well-worn paths and more about forging new ones. By blending sustainability, technology, and diversified strategies, investors and homebuyers can position themselves for success despite muted overall growth.

Whether you’re securing your first rental property, exploring a mixed-use development partnership, or simply upgrading to a greener home, these insights will empower you to make confident, informed decisions. The real estate landscape may be shifting, but with the right approach, you can seize its full potential and build a resilient portfolio that endures long into the future.

References

- https://www.jpmorgan.com/insights/global-research/real-estate/us-housing-market-outlook

- https://www.farther.com/resources/foundations/real-estate-investing-strategies

- https://www.realtor.com/research/hottest-home-trends-2025/

- https://hlcequity.com/potential-of-passive-real-estate-investing-strategies-benefits-and-key-considerations-for-2025/

- https://www.noradarealestate.com/blog/michigan-housing-market/

- https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/ideas-and-insights/alternative-investments-in-2025-our-top-five-themes-to-watch

- https://www.zillow.com/home-values/102001/united-states/

- https://www.pwc.com/us/en/industries/financial-services/asset-wealth-management/real-estate/emerging-trends-in-real-estate-pwc-uli.html

- https://www.reventure.app

- https://www.youtube.com/watch?v=4zyvTqOUv7s

- https://www.nerdwallet.com/investing/learn/the-best-investments-right-now

- https://www.appfolio.com/blog/market-trends-roundtable/