The world stands at a crossroads as fundamental resources once deemed abundant are now under severe strain. From vital minerals and fresh water to food and energy shoring up modern life, escalating demand collides with dwindling supply. This tension poses global growth challenges and inflationary pressures likely to redefine economic landscapes for years to come.

Global Growth Under Pressure

Projections indicate global GDP expanding by just 2.8% in 2025, while inflation hovers around 3.4%. The World Bank’s forecast downgrade to 2.3% underscores how declining growth rates reflect underlying resource constraints and mounting geopolitical friction. This slowdown threatens investment, job creation, and social programs across both developed and emerging economies.

In many advanced nations, central banks grapple with the dual challenge of supporting activity without reigniting inflation. Meanwhile, developing regions face the dilemma of securing capital to bolster infrastructure amid rising borrowing costs. These pressures amplify the urgency of formulating holistic policies that address scarcity and stability together.

Geopolitical Tensions and Supply Chain Disruption

Conflicts in eastern Europe, the Middle East, and trade disputes between major powers have disrupted the flow of critical commodities. The Russia-Ukraine conflict has driven energy prices skyward while the Israel-Hamas war adds uncertainty to grain exports. Meanwhile, US-China tensions threaten tariff escalations on semiconductors and essential minerals.

Governments across the Asia-Pacific are scrambling to secure reliable access to rare earths and strategic inputs. Supply chains once optimized for cost are now being realigned for resilience, shifting production closer to home or diversifying sourcing networks.

- Russia-Ukraine war impacts on energy and food

- Middle East conflicts affecting logistics

- US-China trade tensions and tariffs

- Asia-Pacific initiatives for critical minerals

Regional Growth Projections

Regional variations in growth underscore how resource bottlenecks and policy choices shape economic outcomes. Below is a summary of projected GDP growth rates for 2025:

Landlocked states, despite logistical hurdles, may benefit from a modest growth uptick as inflation eases. In contrast, the CIS region faces a stark slowdown tied to resource reallocation to military spending and labour constraints.

Case Study: Russia’s War Economy

Russia’s experience offers a vivid illustration of how military priorities can reshape an economy riven by resource scarcity. Since early 2022, defence spending surged, injecting cash equivalent to 1-2% of GDP into the military-industrial complex. However, this artificial stimulus has created a fundamental supply-demand imbalance that reverberates through every sector.

- Phase I (2022–23): Crisis management and recovery

- Phase II (2023–24): Overheating and economic distortion

- Phase III (2024–25): Shrinking civilian economy

By spring of 2023, weapons factories cranked to full tilt, exacerbating an acute labour shortage estimated at 2-3 million workers. Every day, casualties drain another thousand working-age people from the labour pool, intensifying the strain on agriculture, construction, and services.

With inflation soaring past 10% annually, everyday Russians face skyrocketing food, energy, and transport costs. Sanctions curb imports of vital machinery, preventing civilian industries from ramping up output to meet demand. The result is a civilian downturn that could deepen unless policy shifts favor broader economic revitalization.

Food and Water Security Crisis

Resource scarcity extends to essentials such as water, food, and fertile land. Over 295 million people experienced acute hunger last year, marking a sixth straight annual increase. Simultaneously, one-third of all food produced is lost or wasted before it reaches plates.

- Conflict-driven supply chain breakdowns

- Climate extremes causing crop failures

- Infrastructure damage and logistical barriers

- Funding gaps in humanitarian response

Sub-Saharan Africa and parts of South America suffer from recurrent droughts and floods that decimate harvests. In Brazil alone, drought losses topped nine billion dollars in 2021. When water becomes a scarce commodity, protests and social unrest soon follow, threatening political stability and regional cooperation.

As famine looms, comprehensive solutions must address waste reduction, sustainable irrigation, and emergency funding to protect the most vulnerable populations.

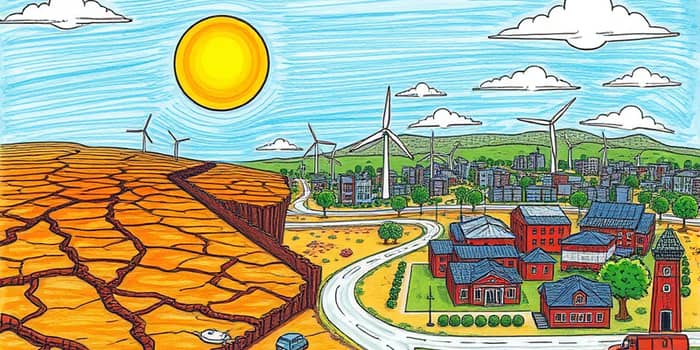

Critical Minerals and Energy Transition

Achieving net-zero emissions by mid-century hinges on securing supplies of lithium, cobalt, nickel, and rare earth elements. These critical minerals power electric vehicles, solar panels, and wind turbines. Yet their extraction and processing often face environmental, social, and governance challenges.

Developing countries with abundant mineral deposits stand at an inflection point. With the right policy frameworks—stabilization funds, equitable revenue sharing, and environmental safeguards—they can transform resource wealth into long-term prosperity. Absent such measures, they risk falling prey to the resource curse, with boom-bust cycles undermining growth and social cohesion.

Leveraging international partnerships and green technology investments can also enhance local value chains, ensuring that host communities reap the benefits of the energy transition revolution.

Building Resilience and Future Outlook

In a world of tightening resources and heightened uncertainty, resilience becomes an economic imperative. Governments, businesses, and civil society must collaborate on multi-pronged strategies that blend preparedness with innovation.

- Advanced scenario planning for resource disruptions

- Investment in recycling and circular economy models

- Decentralized manufacturing and nearshoring

- Cross-border cooperation on water-sharing pacts

- Robust social safety nets for affected communities

Fiscal pressures, including shrinking fiscal space in developing countries and mounting debt service costs, demand bold reforms in taxation and public expenditure. Meanwhile, the risk of stagflation in major economies requires a delicate balance between rate cuts and inflation control.

Ultimately, confronting resource scarcity is not just about managing decline—it is a catalyst for reimagining growth. By embracing sustainability, forging strategic alliances, and empowering local actors, we can turn the tide on scarcity. In doing so, we lay the foundation for a future where prosperity does not come at the planet’s expense, but flourishes in harmony with our natural world.

References

- https://icds.ee/en/resource-scarcity-and-war-are-strangling-russias-economy/

- https://www.spglobal.com/en/research-insights/market-insights/geopolitical-risk

- https://www.anderson.ucla.edu/about/centers/ucla-anderson-forecast/recession-watch-2025

- https://www.fsinplatform.org/report/global-report-food-crises-2025/

- https://www.weforum.org/publications/global-risks-report-2025/in-full/paste-test/

- https://www.rescue.org/article/top-10-crises-world-cant-ignore-2025

- https://www.care.org/news-and-stories/10-crises-to-look-out-for-in-2025/

- https://www.worldbank.org/en/publication/global-economic-prospects