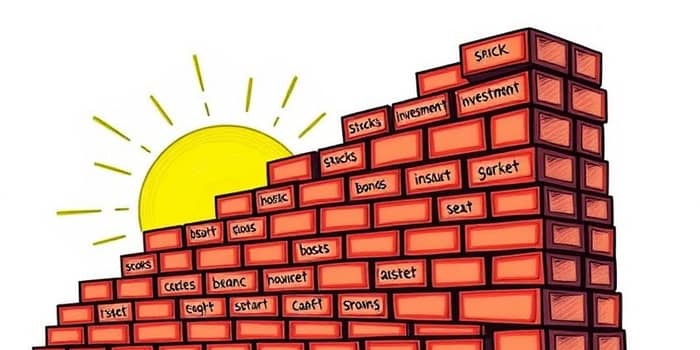

Investing can feel overwhelming, but with a clear plan and steady commitment, you can transform your financial future one brick at a time. By thoughtfully assembling each component of your portfolio, you gain control over risk, growth, and income.

The Foundation: Why Build a Portfolio?

Every successful building project starts with a solid base—and so does your investment journey. A well-constructed portfolio helps you grow long-term wealth sustainably, prepare for retirement, and achieve goals like buying a home or funding education.

Delaying your first investment can carry steep consequences. According to a 2024 Bankrate survey, 22% of people regret not saving earlier for retirement. Time in the market beats timing the market: the sooner you begin, the more you harness compound growth to your advantage.

Asset Allocation & Diversification

Two pillars of prudent investing are asset allocation and diversification. Asset allocation involves dividing your capital among stocks, bonds, real estate, cash, and other categories. Diversification means spreading investments within and across those assets to limit the impact of any single underperformer.

For example, a 100% stock portfolio can plunge by as much as 50% in a severe downturn, whereas a mixed allocation can soften the blow significantly. Choosing assets with low correlation further enhances stability—when stocks fall, bonds or alternatives may hold steady.

Step-by-Step Portfolio Building Process

- Define your investment profile: Clarify financial goals, time horizon, and risk tolerance. Younger investors often embrace more equities for growth; those near retirement typically favor stability.

- Determine your asset allocation: Start with a balanced 60% stocks and 40% bonds approach, then adjust based on comfort with volatility and expected returns.

- Diversify within each category: In stocks, spread across sectors (technology, healthcare, consumer goods) and regions (US, Europe, emerging markets). For bonds, mix government and corporate, varying maturities and credit quality.

- Select securities or funds: Index funds and ETFs offer instant broad-market exposure at low cost. Pair a global equity ETF with a bond fund, then add individual favorites if desired.

- Open and fund accounts: Use tax-advantaged vehicles—IRAs, 401(k)s, ISAs—alongside taxable brokerage accounts to maximize efficiency.

- Review and rebalance regularly: As markets move, your mix drifts. Rebalancing restores your target allocation, ensuring you don’t become inadvertently more aggressive or conservative.

Strategies for Beginners

- Buy and hold: Resist the urge to trade frequently. Holding quality assets for the long term leverages compounding.

- Invest in index funds: Achieve instant diversification with one purchase; avoid the complexity of selecting individual stocks.

- Practice dollar-cost averaging: Invest fixed sums at regular intervals, smoothing out market volatility and eliminating timing risk.

- Consider income-focused assets: Dividend-paying stocks and bonds offer regular cash flows, supporting portfolios at any life stage.

Portfolio Types & Example Allocations

Different investors require different blueprints. Below is a simplified snapshot of three common portfolio types. Tailor these examples to your unique goals and circumstances.

Avoiding Common Pitfalls and Maintaining Your Portfolio

As you construct your financial foundation, stay vigilant against common missteps. Overconcentration in one sector can expose you to undue risk—don’t let a single holding dominate your portfolio.

Emotional investing, driven by fear or greed, often leads to selling low and buying high. Maintain discipline through a clear plan, and use rebalancing to lock in gains and purchase undervalued assets.

Finally, review your strategy periodically. Life events, shifting goals, or economic changes may warrant adjustments. A semiannual check-in ensures your portfolio remains aligned with your vision.

Conclusion: Laying the Final Bricks

Building a resilient portfolio is an art and a science. By following a thoughtful process—defining goals, allocating assets, diversifying wisely, and rebalancing regularly—you create a structure capable of withstanding market winds.

Remember that investing is a marathon, not a sprint. Each deliberate decision places another brick in your financial future. Stay patient, keep learning, and allow time to amplify your efforts. With persistence and prudence, you will watch your portfolio grow, brick by brick, into a lasting monument to your financial success.

References

- https://www.bankrate.com/investing/investment-strategies-for-beginners/

- https://www.home.saxo/learn/guides/diversification/how-to-build-a-diversified-portfolio-in-5-1-easy-steps

- https://marketinsights.citi.com/Financial-Education/Investing/Steps-to-Building-Your-Portfolio.html

- https://www.td.com/ca/en/investing/direct-investing/articles/portfolio-diversification

- https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- https://www.fidelity.com/viewpoints/investing-ideas/guide-to-diversification

- https://www.youtube.com/watch?v=bBSaiEq02Bc

- https://investor.vanguard.com/investor-resources-education/portfolio-management/diversifying-your-portfolio

- https://www.fidelity.com/viewpoints/personal-finance/how-to-start-investing

- https://www.finra.org/investors/investing/investing-basics/asset-allocation-diversification

- https://www.edwardjones.com/us-en/market-news-insights/personal-finance/investment-strategies/how-start-investment-portfolio

- https://www.ml.com/articles/how-to-build-investment-portfolio.html