We live in an era where wealth is no longer measured solely by bank balances or property deeds. Today, more individuals recognize that true abundance includes health, relationships, experiences, and purpose. This broader lens encourages us to ask not just “How much did I earn?” but “How fully am I living?” By embracing a holistic definition of wealth, we unlock pathways to fulfillment that touch every part of our lives.

Redefining Wealth in a Holistic Way

The traditional view of wealth fixates on dollars and cents, but modern research reveals that people value many dimensions of life above net worth. According to Schwab’s 2025 Modern Wealth Survey, Americans increasingly define wealth based on physical health, mental wellbeing, and quality of relationships rather than material possessions alone. This shift highlights what money enables rather than money itself and reframes financial decisions to serve deeper values.

The concept of “Net Worthwhile®” exemplifies this new philosophy. It prioritizes purposeful investing strategies that create freedom to be present for important moments and retirement plans that empower you to pursue your dreams. In this framework, financial choices become instruments to protect loved ones, strengthen communities, and foster personal growth.

The Four Pillars of Lasting Wealth

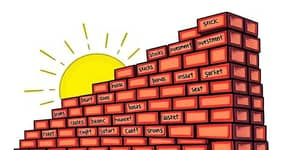

To guide a comprehensive approach to abundance, experts outline four essential pillars—Grow, Protect, Give, and Live. Each pillar represents a dimension where resources can truly flourish:

- Grow: Expanding not only portfolio value but also capacity for impact and personal development.

- Protect: Safeguarding assets, people, values, and opportunities that matter most over the long term.

- Give: Creating purpose through generosity and philanthropy, leaving a meaningful legacy.

- Live: Using resources to curate life experiences that align with your deepest values.

By balancing these pillars, you cultivate a resilient foundation that weathers financial storms and enriches your everyday journey. Ignoring any one dimension can leave you vulnerable—true wealth requires both growth and protection, giving and living.

Global Wealth Distribution: Eye-Opening Realities

While holistic definitions inspire individuals, the global picture reveals striking inequality. The richest 1 percent owns nearly half of all wealth, while more than half the world’s population holds just over 1 percent combined. Such extremes underscore how pivotal it is to design personal wealth strategies that foster both individual prosperity and collective wellbeing.

Consider these distribution brackets for context:

This stark table reminds us that wealth accumulation involves more than chance; it demands commitment to goals and disciplined sacrifice. Yet, it also calls us to consider how our resources can address systemic gaps and uplift communities in need.

Bridging the Gap: Strategies for Building Real Wealth

With a holistic vision and awareness of global dynamics, you can adopt practical strategies that reinforce every pillar:

- Invest in continuous learning and skill-building to foster personal and financial growth.

- Establish emergency funds and insurance plans to provide true financial security and personal freedom.

- Align philanthropic efforts with causes you care about to multiply the impact of your giving.

- Prioritize health, relationships, and travel in your budget to ensure you truly live your values.

Each step may require adjustments—reevaluating spending, automating savings, or seeking professional advice—but the payoff extends beyond numbers. You’ll cultivate resilience, peace of mind, and a deeper sense of purpose.

Beyond Money: Cultivating Wellbeing and Purpose

Financial metrics alone cannot capture the fullness of a thriving life. Wealth today is increasingly understood as holistic and less tied to material wealth. True security means having enough lifetime income to cover future possibilities and the liberty to pursue meaningful goals.

Ask yourself foundational questions as you chart your path:

- If money were no object, how would you spend your days?

- What legacy do you want to leave for family and community?

- Which relationships deserve more time and attention?

- What experiences would make life richer regardless of cost?

Reflecting on these prompts can transform abstract aspirations into actionable plans. When aligned with your values, financial choices become expressions of who you truly are.

Charting Your Own Wealth Journey

Embracing this comprehensive vision of wealth invites you to integrate all facets of life—financial, emotional, relational, and experiential. Begin by defining what success means to you, then map out clear milestones for each pillar. Regularly review progress, celebrate wins, and recalibrate as circumstances evolve.

Remember, wealth is more than a destination; it’s a dynamic journey of growth, protection, giving, and living. By keeping your values at the center and leveraging practical strategies, you’ll not only build assets—you’ll craft a life rich in meaning, purpose, and genuine abundance.

References

- https://signaturefd.com/beyond-the-balance-sheet-discovering-what-wealth-really-means-to-you/

- https://www.statista.com/chart/34240/share-of-wealth-held-by-the-richest-10-percent/

- https://www.schwab.com/learn/story/wealth-is-more-than-money

- https://inequality.org/facts/global-inequality/

- https://beckbode.com/blog/what-is-the-true-definition-of-wealth

- https://www.visualcapitalist.com/global-wealth-distribution/

- https://www.boldin.com/retirement/are-you-wealthy-how-to-define-wealth/

- https://wid.world

- https://smart.dhgate.com/what-does-being-wealthy-really-mean-defining-wealth-beyond-money/

- https://ourworldindata.org/economic-inequality

- https://www.schonbergwealth.co.za/wealth-beyond-numbers-redefining-financial-success/

- https://www.oecd.org/en/data/datasets/income-and-wealth-distribution-database.html

- https://www.oxfamamerica.org/explore/issues/economic-justice/income-and-wealth-inequality/